ScholarshipOwl conducts a monthly survey to better understand the priorities and interests of Gen Z students. In June, we investigated whether or not Gen Z students have the funds needed to pay for costs associated with the upcoming Fall term, including tuition, room and board, books and supplies, etc. Unfortunately, our results show that the overwhelming majority (92%) of respondents are concerned that they won’t have enough funds to pay for the Fall term.

Who participated in the survey?

In June 2023, ScholarshipOwl surveyed over 9,300 high school and college students on the ScholarshipOwl scholarship platform to learn more about how they plan to cover looming college costs. We were particularly interested in finding out if students already have the funds they need for the Fall term, and for those who have a gap to cover, we wanted to know how they plan to “fund their gap.” A total of 9,323 students responded to the survey.

Among the respondents, 65% were female, 34% were male, and 2% identified themselves as other. Nearly half (43%) were Caucasian, 26% were Black, 17% were Hispanic/Latino, 7% were Asian/Pacific Islander and 7% identified as other.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.Check for scholarships

More than one-third (35%) of the respondents were high school students, with the vast majority high school seniors; over half (53%) were college undergraduate students, primarily college freshmen and college sophomores; 9% were graduate students and 4% identified themselves as adult/non-traditional students.

Survey questions

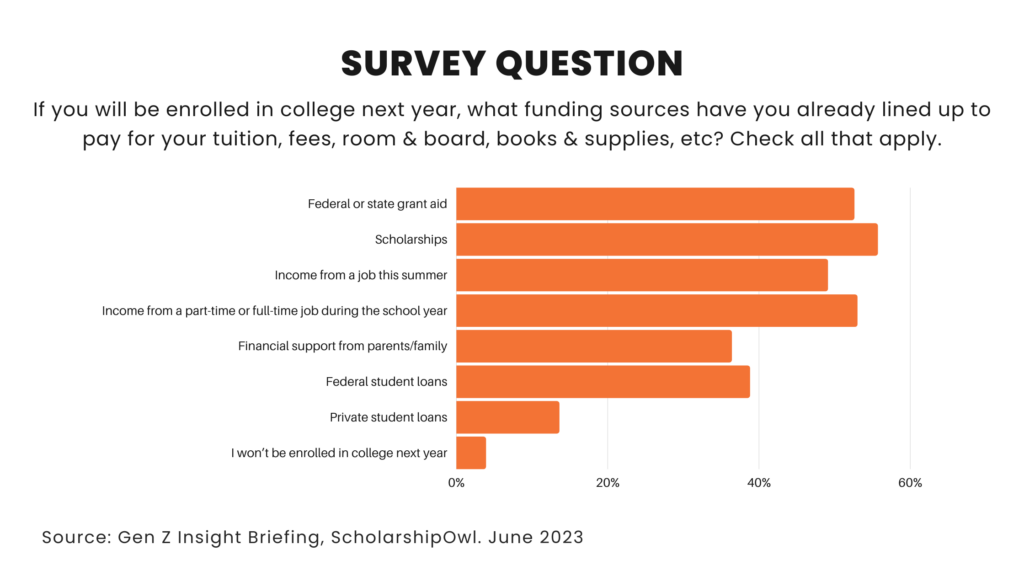

The first survey question was “If you will be enrolled in college next year, what funding sources have you already lined up to pay for your tuition, fees, room & board, books & supplies, etc? Check all that apply.”

The vast majority of respondents indicated that they would use more than one source of funds, with most focusing on debt-free sources. More than half of students selecting federal or state grant aid (53%), and more than half (56%) selecting scholarships. The overwhelming majority indicated that they would be accessing income from employment, with nearly half (49%) stating that they would use income from a job this summer to help pay for college, and more than half (53%) saying that they would use income from a part-time or full-time job during the school year to cover college costs. More than one-third (36%) will have some level of financial support from parents/family. In addition, many students indicated they would be taking on debt that would need to be paid back, with more than one-third (39%) will be taking out one or more federal student loans, and 14% will be taking out one or more private student loans to cover costs. A minority (4%) indicated that they would not be enrolled in college in the coming school year.

We then asked, “Are you concerned that you won’t have enough funds to pay for the Fall term?” We discovered to our dismay that the overwhelming majority (92%) of all students surveyed responded “yes,” that they are concerned they won’t have enough funds for the Fall term.

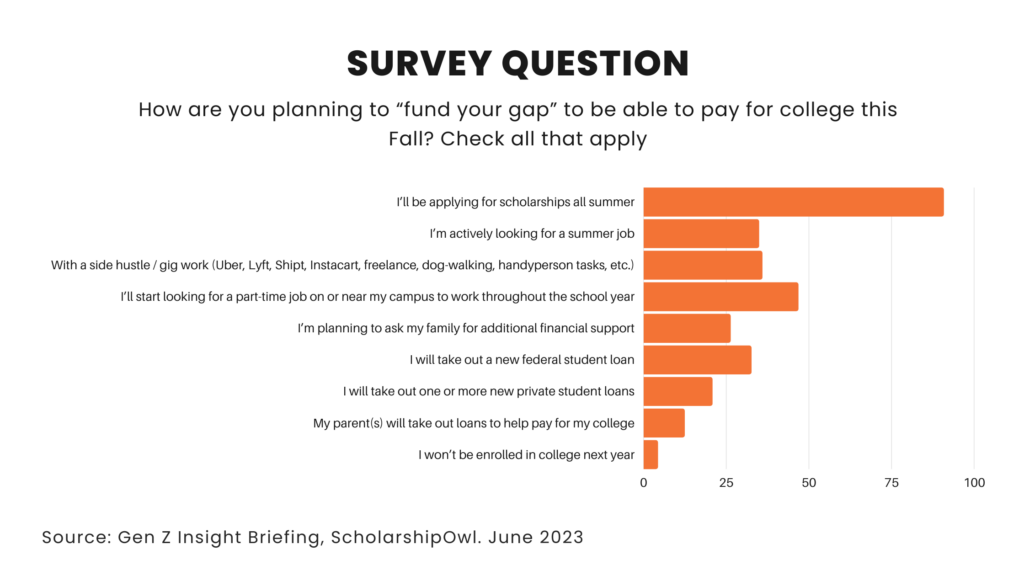

The final survey question was “If yes, how are you planning to ‘fund your gap’ to be able to pay for college this Fall? Check all that apply.” Most respondents selected several strategies that they plan to employ to cover college costs. The overwhelming majority (91%) indicated that they plan to apply for scholarships throughout the summer. Many students are planning to use income from employment to cover costs, with more than one-third (35%) stating that they are actively looking for a summer job, and nearly half (47%) saying that they plan to look for a part-time job on or near campus so that they can work throughout the school year. More than one-third (36%) plan to earn income through a side hustle / gig work, such as driving for a food delivery service or ride-sharing app, taking on freelance work, dog-walking, handyperson tasks, etc. Over one-quarter of respondents (26%) are planning to ask family for additional financial support. Many respondents indicated that they would be “funding their gap” with loans – One-third (33%) plan to take out one or more new federal student loans, and 21% plan to take out one or more new private student loans. And 12% say that their parents will take out loans to cover their college costs. A small percentage (4%) indicated that they will not be enrolled in college in the coming school year.

Key takeaways for Gen Z students

The survey results indicate that Gen Z students are aware of the multiple avenues they can access to be able to cover college costs, and the good news is that they are primarily focused on sources that don’t have to be repaid (federal and state grants, scholarships, income from employment). That said, more than one-third plan to take out student loans, even if they also have non-loan funding sources. The results also indicate that students are relying on their parents/families for financial assistance, with more than one-third already receiving support from family, and one-fifth planning to ask for additional family support to “fund their gap.”

Brands can be the solution

Clearly, there still are not nearly enough debt-free sources available to support the millions of students who have a funding gap to fill before the Fall term begins. More scholarships are sorely needed, and the businesses and organizations that offer them need to do a better job of reaching the students who are seeking them. Brands can help by offering scholarship campaigns through the ScholarshipOwl for Business platform. Through this platform, brands can create and launch scholarship campaigns, and promote them to the millions of students who apply for scholarships on the ScholarshipOwl platform. This benefits both students and brands, enabling businesses to build relationships with Gen Z in support of their marketing and communication goals.

To find out more about creating and launching a scholarship campaign, visit business.scholarshipowl.com.